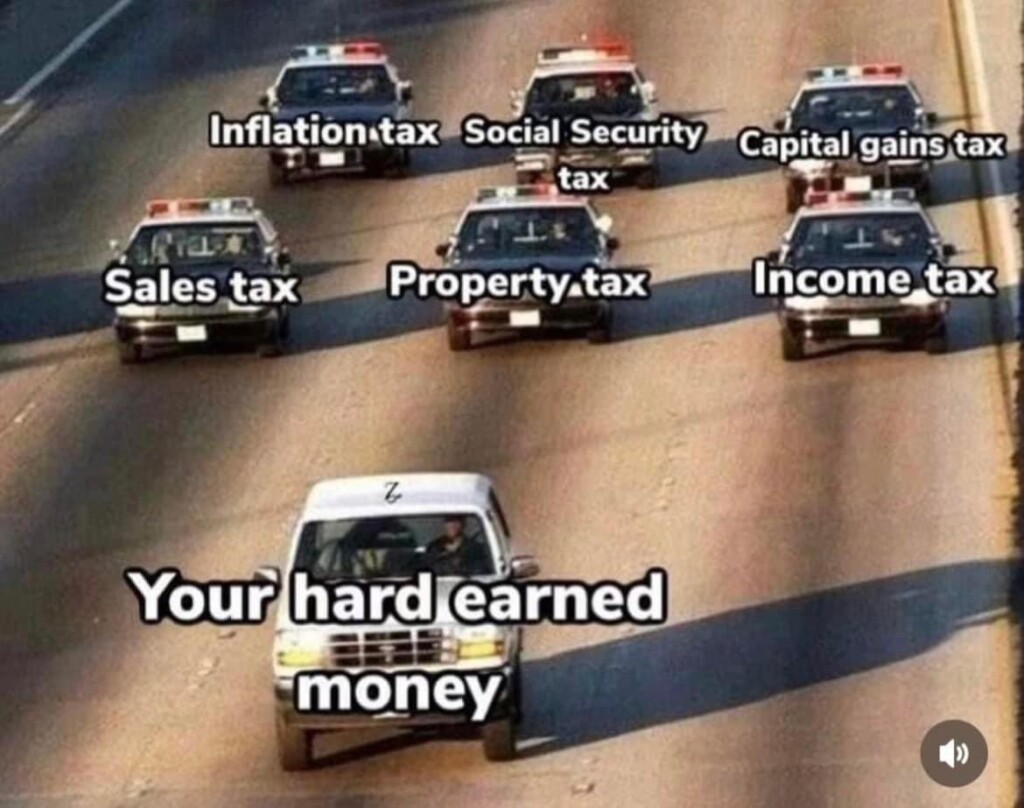

Greetings, legal minds in the realm of finance! If you’ve ever felt like your hard-earned money is relentlessly pursued by an intricate web of taxes and fees, you’re not alone. From property taxes to income taxes, sales tax to license fees, and a labyrinth of deductions, it’s a landscape where legal implications intertwine with financial matters. Join us as we delve into this complex terrain, uncovering its legal dimensions and strategies to navigate it within the bounds of the law.

Property Taxes: Legal Context Unveiled

Envision your mailbox as a recurring destination for the annual visitor – the property tax bill. While these contributions fund vital local services, their legal implications and implications on ownership rights must be acknowledged. By understanding the legal framework behind property tax calculations, you can navigate this aspect of property ownership while upholding your rights.

Income Taxes: The Annual Legal Choreography

Enter the arena of income taxes – an annual choreography entwined with legal stipulations. This is the time of year when meticulous documentation and adherence to tax codes take precedence. Unraveling the legal nuances of tax credits, deductions, and staying abreast of evolving tax laws is essential to safeguarding your financial standing within the legal framework.

Sales Tax: The Subtle Legal Consideration

With every purchase, an inconspicuous legal participant emerges – sales tax. Often overlooked, these incremental contributions hold legal implications that vary across jurisdictions. Navigating the legal landscape of state-specific sales tax regulations ensures compliance and informed financial decision-making.

License Fees: Legal Aspects Exposed

While vehicles offer freedom, they’re also subject to legal constraints in the form of license fees. From registration to emissions tests, understanding the legal implications and obligations surrounding vehicle ownership is paramount. Equipping yourself with knowledge of the legal intricacies can help you steer clear of potential legal entanglements.

Social Security Tax: Legal Perspectives

A familiar entry on pay stubs – the Social Security deduction. It’s a contribution with legal ramifications that extend into your future. Exploring the legal dimensions of Social Security and comprehending its long-term legal implications enhances your understanding of its role within the legal spectrum.

Navigating the Legal Horizon

Ladies and gentlemen, within the legal arena, the world of finance is intertwined with intricate legal considerations stemming from taxes and fees. Empowered by legal insights and strategic acumen, you can traverse this multifaceted landscape while adhering to legal boundaries. Thorough legal research, meticulous financial planning, and legal awareness of tax laws and amendments serve as beacons in the realm of compliance. Remember, as taxes and fees persist, your legal acuity guides your financial voyage within the realm of law.

As an Amazon Associate we earn from qualifying purchases through some links in our articles.